One of the most unexpected pandemic winners might just turn out to be new small businesses.

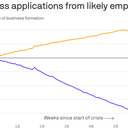

Why it matters: The number of entrepreneurs starting a business easily hit a record high in 2020, according to a new analysis by University of Maryland economist John Haltiwanger. That’s a surprising result, given the severity of the crisis.

The big picture: It’s now much easier than it was in 2008 to start a small business selling goods or services online.

- By far the largest single sector of new business formation is “nonstore retailers,” who account for one of every three new businesses formed over the pandemic. They were helped at every step of the process by e-commerce platforms such as Shopify and Stripe, which wasn’t even founded until 2009.

- Be smart: Renting space on Instagram is a lot easier, and can scale a lot more quickly, than renting a storefront.

Physical businesses have been booming too — but largely in states where rents are relatively low, like Texas, Florida, and Georgia. Those states have seen much more new business formation than high-rent California, New York, and New Jersey.

- When the Wall Street Journal told the story of how businesses on one Chicago street are coping with the pandemic, it found that out of nearly 50 businesses on the strip, five had closed permanently — while 10 new businesses had arrived.

- Sectors seeing a lot of new openings include laundromats, trucking, and, possibly surprisingly, restaurants.

How it works: One of the biggest differences between the crises of 2008 and 2020 is that the former was associated with an extreme lack of money, while the latter saw an abundance of it.

- In 2008, Americans lost billions of dollars in home equity, even as the stock market was crashing and banks stopped lending.

- The pandemic, by contrast, unleashed trillions of dollars in new government spending, much of it targeted directly at small businesses in the form of forgivable Paycheck Protection Program (PPP) loans that helped prevent many small businesses from closing. There was also — thanks in large part to the Federal Reserve — no financial crisis. As a result, America’s banks have been financially strong throughout, and in fact have been desperate to find businesses to lend money to.

- A surging stock market has also helped provide up-front capital that some entrepreneurs need.

Of note: “The surge in applications for likely employer businesses is arguably not because of, but despite, the PPP program,” writes Haltiwanger. After all, PPP money went only to old businesses, thereby giving them a competitive advantage with respect to anybody who wanted to start a new business after February 2020.

- Government help was also frequently slow to arrive, which implies that the real driver of new business formation was not the government but just the underlying wealth and hopefulness of individual Americans.

Yes, but: There’s no solid data on how many small businesses closed during the recession. A recent Fed paper, however, suggests that about 130,ooo firms went out of business in the first year of the pandemic — up between a quarter and a third from normal levels, and much lower than many economists originally feared.

The bottom line: If the Fed’s number is accurate, the total number of small businesses may have gone up, not down, over the course of the pandemic. Either way, what’s certain is that Americans have been starting small businesses at an unprecedented pace.

Source: https://www.axios.com/small-business-formation-boom-3b2d7079-c3cc-4fb9-aa18-9271e924dea8.html

Droolin’ Dog sniffed out this story and shared it with you.

The Article Was Written/Published By: Felix Salmon

! #Headlines, #Axios, #BusinessNews, #CoronaVirus, #Economy, #Money, #Newsfeed, covid19, new york nyc NY nypd nyfd, pandemic, #Coronavirus, #News, #Science

No comments:

Post a Comment